The Indian stock market, which hit record highs earlier this month, is now facing a dual-threat environment that demands a sophisticated tactical shift from retail and institutional investors alike.

The Indian stock market, which hit record highs earlier this month, is now facing a dual-threat environment that demands a sophisticated tactical shift from retail and institutional investors alike.

Having watched the "India Story" unfold for three decades, I’ve seen the listing of Indian giants like Infosys, Wipro, and HDFC Bank on American exchanges evolve from a rare prestige move into a strategic masterstroke for global capital.

The unprecedented criminal probe into US Fed Chair Jerome Powell by the Justice Department has sent shockwaves through the global financial ecosystem, and for the Indian investor, this is far from a distant political drama. At its core, this investigation—triggered by grand jury subpoenas regarding headquarters renovation costs and Powell's June 2025 testimony—is widely viewed as a "pretext" for administrative pressure to force aggressive interest rate cuts. For Dalal Street, the immediate fallout is heightened volatility across the Rupee and FII flows.

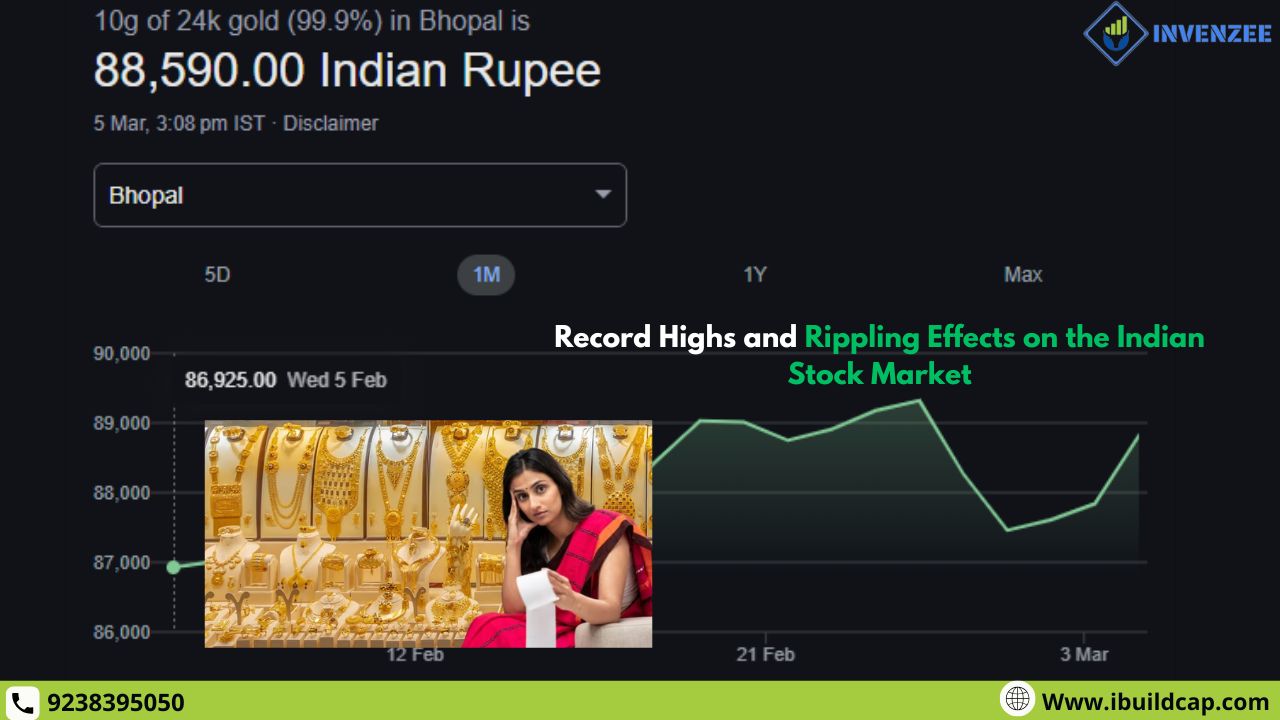

The year 2025 will go down in Indian market history as the year the "safe haven" stole the show. While the Nifty 50 struggled to deliver a 10.5% return amidst global headwinds and FII outflows, gold prices surged by a staggering 74-75%, marking one of the most intense periods of bullion out performance in 40 years.

The market reacts to the threat of a storm long before the first raindrop falls. Today, the "storm" is the Sanctioning Russia Act of 2025, which President Trump has officially greenlit.

The stock market is a master of irony, and today’s session was a masterclass in it. Just 24 hours after Reliance Industries (RIL) scaled a fresh mountain to hit an all-time high of ₹1,611.80, the "Big Boy" of Dalal Street suffered its most brutal intraday hit since June 2024.

The dramatic US military intervention in Venezuela—culminating in the capture of President Nicolás Maduro—is less about a "regional skirmish" and more about a tectonic shift in the global energy order.

The sudden plunge in ITC share prices today is primarily driven by a "double whammy" of regulatory pressure and taxation anxiety following a surprise government notification regarding excise duty hikes.

The most "obvious" stories are often the most dangerous. On January 2, 2026, Vodafone Idea (Vi) finds itself at a surreal crossroads: just hours after the Union Cabinet reportedly cleared a massive moratorium on ₹87,695 crore of AGR dues—sending the stock on an 8% roller-coaster—the Ahmedabad CGST authorities slapped the company with a ₹637.9 crore penalty.

The NSE’s "Futures & Options" (F&O) list evolve from a small club of blue-chip giants to a dynamic mix of new-age tech and energy leaders. The latest announcement is a major milestone: Swiggy, Waaree Energies, Premier Energies, and Bajaj Holdings are officially entering the derivatives segment on December 31, 2025

Investors hate two things: losing customers and rising bills. Right now, IndiGo is facing both. The stock price recently dropped by nearly 2% because the airline’s slice of the Indian market fell from 65.6% to 63.6%.

The meteoric rise of Swan Defence and Heavy Industries (SDHI) to all-time highs is the result of a spectacular corporate turnaround, transforming the once-stagnant Pipavav shipyard into a lean, "Make in India" powerhouse.

After 30 years of watching market cycles, investors seen that the biggest gains often come when you stop waiting for a local opportunity and start looking where the smart money is actually flowing. With Samsung Southwest Asia CEO JB Park officially ruling out an India IPO for now, domestic investors who were holding out for a "Hyundai-style" blockbuster need to pivot immediately.

The 90% of traders who lose money in the Indian markets usually fall into the same trap: they react emotionally to Red and Green candles while ignoring the institutional data moving beneath the surface.

The 2025 year-end "disaster" in the Indian markets has been a brutal reality check, driven by a relentless FII exodus—with nearly ₹1.6 lakh crore drained—and a cooling of post-pandemic euphoria. After years of mid-cap madness, we are witnessing a painful but necessary valuation reset where the Nifty's P/E has finally retreated toward its long-term average.

The initial public offering (IPO) of Wagons Learning Private Limited is set to open for subscription tomorrow, May 2, 2025, and will close on May 6, 2025. This IPO presents an opportunity for investors to participate in the growth story of an education technology company focused on providing innovative learning solutions. Here's a detailed look at the IPO:

The primary market is buzzing with activity, and Kenrik Industries Limited is the latest company to tap into investor interest with its Initial Public Offering (IPO). Scheduled to open for subscription on April 29, 2025, and close on May 6, 2025, this fixed-price IPO aims to raise ₹8.75 Crores through the issuance of 34,98,000 fresh equity shares. Here's a detailed look at what you need to know about the Kenrik Industries IPO.

The initial public offering (IPO) of Iware Supplychain Services Limited has opened for subscription (April 28th - April 30th, 2025), presenting a compelling opportunity for seasoned investors to gain exposure to India's evolving logistics and supply chain sector. This fixed-price IPO, aiming to raise ₹27.13 Crore, warrants a detailed examination by those with a keen understanding of market dynamics and growth potential.

Ather Energy, a prominent Indian OEM in the electric two-wheeler segment, is poised to tap the primary markets with its upcoming IPO, scheduled from April 28, 2025, to April 30, 2025. This offering provides a direct exposure to India's burgeoning EV ecosystem, specifically within the high-growth personal mobility vertical. This analysis delves into the nuances of the IPO for sophisticated investors.

The tech world is abuzz with the impending launch of the Ray-Ban Meta smart glasses in India. These aren't your average shades; they're packing cutting-edge AI features, including the highly anticipated live translation support. For investors tracking the Indian tech market, this development could represent more than just a cool gadget – it might signal emerging opportunities and potential shifts in the landscape.

Remember the buzz? The constant chatter about when gold would finally dip to ₹56,000 per 10 grams? It felt like everyone was holding their breath, patiently waiting for that opportune moment to add the precious metal to their portfolio. The reasons were varied – a predicted market correction, historical analysis suggesting a downward trend, or simply a desire for a more accessible entry point into gold investing.

For high-level finance professionals and institutional investors, the specter of potential RBI rate cuts in FY26 warrants a nuanced analysis of the impending impact on the banking sector's profitability. While accommodative monetary policy can stimulate economic expansion, the inherent compression of net interest margins (NIMs) presents a strategic challenge for financial institutions. Understanding the dynamics at play and the proactive measures banks are likely to adopt is crucial for informed decision-making.

The digital payments landscape in India is buzzing with anticipation as one of its biggest players, PhonePe, is firmly on the path to an Initial Public Offering (IPO). This move, long speculated, is now taking concrete shape, and promising to be one of the most significant events in the Indian financial markets in the coming year.

The investment landscape surrounding the Adani Group has witnessed an interesting shift in the latest quarter ending March 2025. While Foreign Institutional Investors (FIIs) appear to be taking some chips off the table, a strong wave of buying from domestic powerhouses like LIC, insurance companies, and pension funds is painting a contrasting picture. This divergence in investment strategies raises pertinent questions about the future trajectory and valuation of the conglomerate.

The investment landscape surrounding the Adani Group has witnessed an interesting shift in the latest quarter ending March 2025. While Foreign Institutional Investors (FIIs) appear to be taking some chips off the table, a strong wave of buying from domestic powerhouses like LIC, insurance companies, and pension funds is painting a contrasting picture. This divergence in investment strategies raises pertinent questions about the future trajectory and valuation of the conglomerate.

The Indian Primary Market, a space usually buzzing with the anticipation of new listings, has experienced a noticeable quietude in April 2025. While the early days of the month saw activity primarily within the Small and Medium Enterprises (SME) segment, the IPO pipeline seems to have temporarily dried up, particularly for larger Main board issues, after the initial listings around April 8th. This lull has prompted questions and a closer look at the factors potentially at play.

For a considerable period, the journey of Data Motors on the stock market has been a bumpy ride, leaving investors with more questions than gains. However, the tide appears to be turning, with the company's shares showing signs of a positive trajectory after a prolonged lull. What are the underlying factors fueling this potential resurgence? Let's delve into the key drivers that could propel Data Motors' stock into a brighter future.

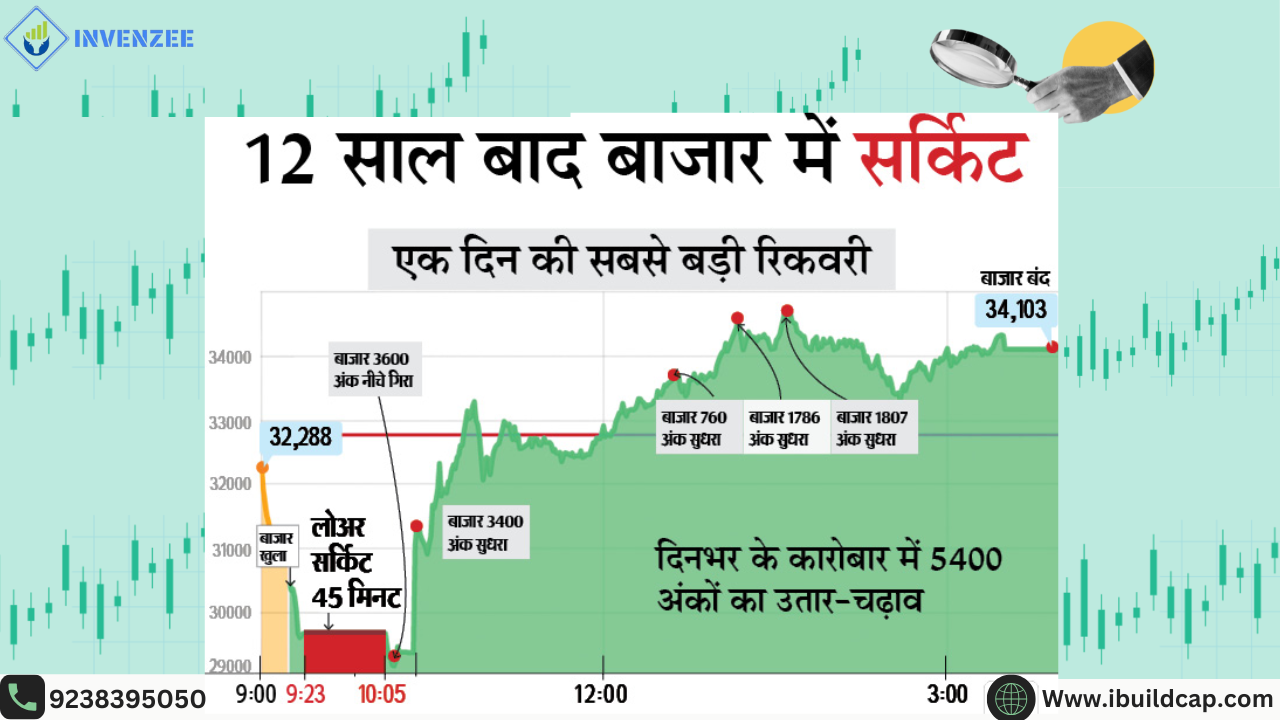

The Indian stock market, a barometer of national economic sentiment, is currently experiencing seismic shifts. We are not merely observing fluctuations; we are witnessing a full-blown market quake, triggered by the relentless aftershocks of global trade war tensions. This volatility is not a passing storm; it's a fundamental re-calibration, demanding a strategic and deeply analytical response.

The Indian stock market, a vibrant tapestry of dreams and anxieties, dances to a rhythm dictated by two powerful forces: Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs). Their capital, their strategies, their very presence, casts long shadows, shaping the market's trajectory with a force that can leave retail investors breathless. To ignore their influence is to navigate a storm blindfolded.

“Tariffs” that word alone can conjure up images of trade wars, rising prices, and economic uncertainty. But like most things in economics, the story isn't always black and white. Tariffs, essentially taxes on imported goods, have two distinct sides, and sometimes, those sides can lead to surprising outcomes.

The latest RBI Monetary Policy Committee (MPC) meeting has delivered a welcome dose of good news: a 25 basis point (bps) reduction in the repo rate, bringing it down to 6%, effective immediately. In a world often filled with economic uncertainty, this decision shines a bright light on potential financial relief for many.

The gleam of gold, long considered a safe haven and a symbol of enduring value, might be facing a significant shift. Whispers and predictions are circulating that gold prices, particularly in India, could be poised for a substantial drop, potentially hitting the ₹56,000 per 10 grams mark. Is this a fleeting rumor or a looming reality? Let's delve into the factors that are fueling this speculation.

In a sea of red, a single green shoot emerged, capturing the attention of investors and analysts alike. While the Indian stock market faced a significant downturn, HDFC Bank's share price defied the trend, showcasing remarkable resilience and sparking a wave of optimism. This unexpected jump isn't just a fluke; it's a testament to the bank's fundamental strength, strategic foresight, and unwavering investor confidence.

The Indian IT sector, a bellwether for the nation's economic health, has been experiencing a significant downturn. While the broader market has seen fluctuations, midcap IT stocks, particularly names like Persistent Systems and Coforge, have witnessed a sharper decline. This has left investors wondering: what's driving this disproportionate fall?

"Some ran 20%... some 10%, stock market boomed before Trump's tariff, closed with strong gains," has certainly piqued your curiosity. Let's delve into the reasons behind this event, the opportunities for Indian investors, and the potential challenges.

"The global trade landscape is poised for a seismic shift on April 2nd, with the implementation of President Trump's 'reciprocal tariff' policy. This development necessitates a strategic re-evaluation of portfolio allocations for Indian investors, given the potential for significant market volatility and sectoral disruptions."

Hindustan Petroleum Corporation Limited (HPCL) has emerged as a focal point for discerning investors, driven by a confluence of nuanced market dynamics and intrinsic sector potential. A rigorous examination of its performance reveals opportunities for strategic alpha generation within a complex energy landscape

As the first quarter of the year concludes, the Indian market is witnessing a dynamic period of Initial Public Offerings (IPOs). For global investors seeking growth opportunities, these IPOs present potential, but require careful analysis.

The hashtag #BeATaxNinja AdityaBirlaSunLifeInsurance isn't just a regional phenomenon; it's a prime example of how financial literacy and tax-saving strategies can capture global attention. While rooted in the Indian market, the underlying principles resonate universally. Let's explore why this campaign is gaining traction and why its core message is fundamentally sound for tax optimization.

The world's eyes are on India as its Parliament's Budget Session unfolds, with the Finance Bill 2025 poised to be a key determinant of market sentiment. While domestic investors dissect every detail, global players are asking: will this budget unlock new opportunities or signal potential headwinds?

The roar of the crowd, the crack of the bat, the dizzying spectacle of the Indian Premier League (IPL) – it's more than just cricket. It's a national festival, a cultural phenomenon, and, crucially, a goldmine for sponsors. As the sixes fly and the wickets tumble, so too do the fortunes of companies strategically leveraging this high-octane platform. But why does the IPL create such a potent, positive, and profitable market for investors? Let's delve into the economics behind the boundary ropes.

The Indian Premier League (IPL) isn't just a cricket tournament; it's a cultural phenomenon. A whirlwind of entertainment, celebrity glamour, and intense competition, it captivates millions across India and the globe. But beyond the sixes and wickets, the IPL's influence extends into the financial realm, particularly the Indian share market. While some might dismiss the hype as mere entertainment, a closer look reveals a tangible, positive impact.

The Indian equity landscape is witnessing a dynamic shift, with the SME segment emerging as a focal point for discerning investors. This surge, while presenting lucrative opportunities, necessitates a nuanced approach, particularly within high-growth sectors like logistics and road transportation. The upcoming Rapid Fleet Management Services Limited IPO (Rapid Fleet IPO) warrants a strategic analysis.

The hum of the global marketplace just hit a discordant note, and Indian investors are feeling the vibrations. Recent US tariff adjustments, specifically targeting key Indian exports, have injected a dose of uncertainty into the market. As savvy investors, we need to dissect these developments, understand their potential impact, and strategize accordingly.

The hospitality sector, a perennial indicator of economic vitality, is once again under the spotlight. Grand Continent Hotels is set to debut on the NSE SME platform with its Initial Public Offering (IPO) opening from March 20th to March 24th, 2025. With a price band of ₹107 to ₹113 per share, this IPO presents an opportunity for investors to participate in the company's growth story. But is it a golden opportunity or a cautious stay? Let's delve into the details.

Bharti Airtel's recent partnership with SpaceX to bring Starlink's satellite internet to India has ignited a flurry of excitement and apprehension. While the prospect of high-speed, reliable internet reaching the remotest corners of the country is undeniably thrilling, the potential ramifications for the existing telecom landscape are equally significant. Let's delve into the positive and negative aspects of this groundbreaking development.

Gold has always held a special place in the hearts of investors and consumers alike. In recent times, the precious metal has seen a significant surge in prices, driven by a confluence of global economic factors. This trend has naturally piqued the interest of those looking to diversify their investment portfolios, and it also casts a spotlight on companies operating within the gold and jewelry sector. One such company preparing to enter the public market is Divine Hira Jewellers, with its upcoming IPO.

The Indian stock market is buzzing with activity, and the upcoming Paradeep Parivahan IPO is generating significant interest. If you're looking for a potential growth opportunity in the SME sector, this IPO deserves your attention. Let's dive into the details and analyze whether this offering aligns with your investment goals.

Gold has surged, shattering previous records and hinting at the potential for even greater heights. This isn't just a blip; it's a significant economic phenomenon with far-reaching consequences, especially for the Indian share market.

The cryptocurrency market, known for its volatility, recently delivered a thrilling ride for investors. In a single day, major tokens like Cardano (ADA), Solana (SOL), XRP, and even the stalwart Bitcoin (BTC) witnessed dramatic price surges, with some altcoins experiencing gains of up to 75%. This sudden rally has ignited renewed interest in the digital asset space, prompting both seasoned traders and curious newcomers to analyze the underlying factors.

The Indian financial landscape is bracing for change as Tuhin Kanta Pandey, the outgoing Finance Secretary, has been appointed the new Chairman of the Securities and Exchange Board of India (SEBI) for a pivotal three-year term. This decision, green lit by the Appointments Committee of the cabinet, signals a strategic move to leverage Pandey's extensive experience in navigating complex economic and financial terrains.

The initial public offering (IPO) of Nukleus Office Solutions, a prominent player in the workspace solutions and interior contracting sector, has garnered significant attention, reaching 87% subscription on the third and final day of its bidding period. This report delves into the key aspects of the IPO, including its subscription status, Grey Market Premium (GMP), price band, and other crucial details.

The Indian IPO market is buzzing with activity, and one name that's catching the attention of investors is NAPS Global India. This fixed price issue promises an opportunity to be part of a growing company. Let's break down the key details and understand what this IPO entails.

Today, the rhythmic hum of India's financial heartbeats, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), falls silent. In observance of Mahashivratri, the day dedicated to Lord Shiva, the trading floors are closed, bringing a temporary pause to the relentless ebb and flow of the market.

The Indian stock market is buzzing with IPO activity, and one name catching the attention of investors is Balaji Phosphates Limited. Scheduled to open for subscription from February 28th, 2025, to March 4th, 2025, this NSE SME IPO presents a potential lump sum investment opportunity for those seeking exposure to the agricultural inputs sector.

The Indian paper industry, a vital cog in numerous sectors, is witnessing the emergence of specialized supply chain players. Among them, Shreenath Paper Products Limited is gearing up to launch its Initial Public Offering (IPO), offering investors an opportunity to participate in its growth story. Let's delve into the details of this upcoming IPO.

The co-working and managed office space sector in India, particularly in bustling hubs like Delhi NCR, is witnessing significant growth. Catering to the evolving needs of startups, SMEs, and even large enterprises, flexible workspace solutions are becoming increasingly popular. In this context, Nukleus Office Solutions Limited is set to launch its Initial Public Offering (IPO), offering investors an opportunity to participate in this growing market.

Alright, buckle up, auto enthusiasts! We're diving deep into the electrifying transformation of India's automotive landscape. It's no longer just a market; it's a powerhouse, and the world is taking notice.

The year 2025 marks a significant milestone in the bilateral relationship between India and Qatar, as both nations elevate their ties to a strategic partnership. This enhanced alliance signifies a shared vision for growth, cooperation, and mutual prosperity, with a strong focus on trade, investment, and energy.

The Indian stock market is buzzing with upcoming IPOs, and one that's catching attention is Beezaasan Explotech Limited. Set to open for subscription on February 21, 2025, and close on February 25, 2025, this IPO offers investors a chance to participate in the growth of a company operating within a crucial sector. Let's delve into the details and analyze what makes Beezaasan Explotech tick.

The Indian stock market is buzzing with activity, and the upcoming IPO of HP Telecom India Limited is generating quite a bit of interest. Founded in 2011, HP Telecom has evolved from a mobile phone distributor to the exclusive distributor of Apple products in key regions of India. This evolution makes their IPO an intriguing prospect for investors. Let's dissect the offering and see what it holds.

The Indian stock market is buzzing with activity, and one of the upcoming events catching investors' attention is the Initial Public Offering (IPO) of Royalarc Electrodes Limited. This blog post provides a comprehensive overview of the IPO, helping you make an informed decision should you choose to invest.

Tejas Cargo is going public with its initial public offering (IPO), opening for subscription on February 14, 2025, and closing on February 18, 2025. This blog post provides a comprehensive overview of the Tejas Cargo IPO, including key details, dates, and other important information for potential investors.

The Indian stock market is about to see a new entrant with the upcoming Initial Public Offering (IPO) of L.K. Mehta Polymers. Here's a brief overview of what you need to know about this IPO:

Birlasoft's share price took a significant hit today, plummeting over 7% after the release of their Q3 results. The numbers appear to have fallen short of market expectations, prompting a strong reaction from investors and analysts alike. Notably, brokerage firm Nuvama has labeled the results "highly disappointing," further contributing to the negative sentiment surrounding the stock.

The Indian stock market is buzzing with upcoming IPOs, and one that's catching attention is the Quality Power Electrical Equipments Limited IPO. If you're considering investing, here's a comprehensive overview to help you make an informed decision.

Seeking a slice of the interior solutions market? The Eleganz Interiors IPO is on the horizon, offering investors an opportunity to participate in the growth of a company specializing in fit-out solutions for diverse commercial spaces.

Readymix Construction Machinery Limited is going public with its Initial Public Offering (IPO) on the NSE SME exchange

The Initial Public Offering (IPO) of Ajax Engineering is generating significant interest in the market. This blog post provides a detailed overview of the IPO, including key details, financial implications, and what potential investors should consider.

The IPO was oversubscribed 147 times and listed at a premium of ₹2 per share. However, the grey market premium (GMP) for the IPO was volatile, with the lowest GMP being ₹2 and the highest being ₹28. This suggests that the IPO may have been overvalued, and the listing price may not have been sustainable.

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has generated a lot of buzz, particularly regarding its potential impact on the middle class. While some applaud the budget for its focus on infrastructure development and economic growth, others feel it falls short of addressing the pressing concerns of the common man.

Contrary to some expectations, the stock market will remain open on February 1st, 2025, the date of the Union Budget announcement. Both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) have confirmed that regular trading activity will proceed as scheduled.

The Indian share market is bracing itself for a potentially volatile day on February 1, 2025, as Finance Minister Nirmala Sitharaman presents the Union Budget for the fiscal year 2025-26. While the budget is a highly anticipated event that often sets the tone for the market, there are concerns that it could trigger a crash this year.

The Indian stock market experienced a significant downturn in late January 2025, impacting mutual fund performance. This decline sparked concerns among investors, raising questions about the health of the Indian share market and its future trajectory.

The Indian IT sector has been witnessing a wave of selling pressure in the days leading up to the Union Budget 2025, scheduled for February 1st. This selling spree can be attributed to a confluence of factors, primarily centered around the anticipation of the budget announcements and the sector's recent performance.

One such opportunity lies in the upcoming Dr. Agarwal's Healthcare IPO, slated to open on January 29th, 2025, and close on January 31st, 2025. This IPO presents a unique chance for investors to participate in the growth story of a leading player in the Indian eye care market.

The US, a global economic behemoth, wields significant influence on markets worldwide. Recent policy shifts and regulatory changes emanating from across the Pacific can have a profound impact on the Indian share market. Let's delve into some key areas and their potential repercussions:

The Indian stock market is poised for a dynamic week, influenced by a confluence of factors: the anticipated launch of Jio Coin, the emergence of the Trump Meme Coin, and the impending Union Budget presentation on February 1st.

IPO Overview Denta Water and Infra Solutions Limited is set to launch its Initial Public Offering (IPO) on Wednesday, January 22, 2025, with a price band of ₹279 to ₹294 per share. The IPO will remain open for subscription until January 24, 2025.

Get ready for a crypto revolution! India's richest man, Mukesh Ambani, has just dropped a bombshell: his own cryptocurrency. No, you won't be listening to it (though that might be a future innovation!).

In a recent development, depositing more than ₹10 lakh in cash into a savings account now requires PAN card details and proof of income sources. This regulation aims to combat money laundering and tax evasion.

The highly anticipated Stallion India IPO is set to open for subscription on January 16, 2025, and will conclude on January 20, 2025. With the allotment expected to be finalized on January 21, 2025, investors are eagerly awaiting the potential listing on BSE and NSE on January 23, 2025.

Avax Apparels, a leading manufacturer and exporter of knitted garments, made a spectacular entry into the capital markets today. The company's shares listed at a whopping 90% premium over the issue price of ₹70 on the BSE SME platform, opening at ₹133 per share.

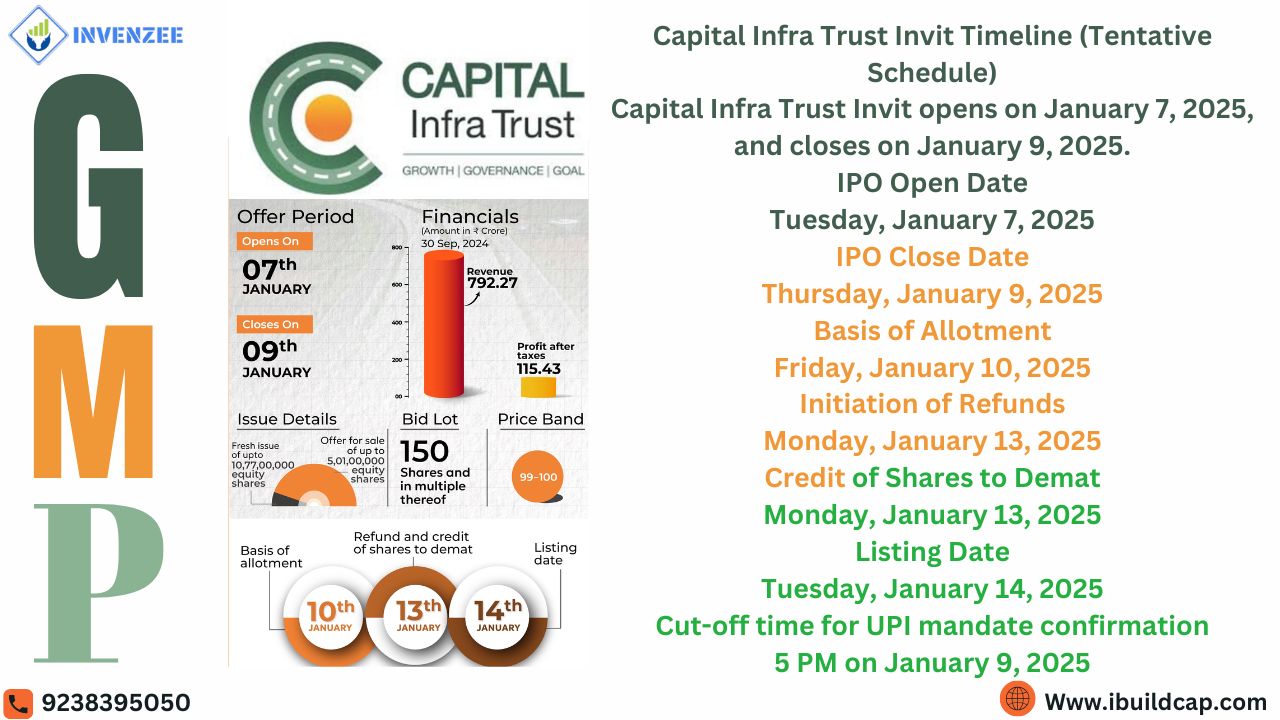

The Capital Infra Trust InvIT IPO is currently trading at a Grey Market Premium (GMP) of zero. This indicates that the current market sentiment suggests a listing price around the issue price of ₹100 per share.

Adani Wilmar Ltd. (AWL) shares took a significant hit today, plummeting nearly 9%, following the announcement of a promoter stake sale through an Offer for Sale (OFS). This development has sent ripples across the market, raising concerns among investors.

The Laxmi Dental IPO has recently hit the market, a book built issue aiming to raise Rs 698.06 crores. This offering comprises a fresh issue of Rs 138.00 crores and an offer for sale of Rs 560.06 crores. Let's delve deeper into this IPO and assess its potential.

The Indian stock market has witnessed a remarkable journey, scaling new heights and leaving its mark on the global financial landscape. As we step into 2025, the question arises: Is the Indian market ready for another surge?

The Quadrant Future Tek Limited Initial Public Offering (IPO) is set to open on January 7, 2025, and close on January 9, 2025. With a strong Grey Market Premium (GMP) exceeding 210, this IPO has garnered significant attention from investors. Let's delve into the key aspects of this offering.

The recent detection of Human Metapneumovirus (HMVP) cases in India has sparked concerns among investors, leading to a slight dip in the stock market. While the situation is being closely monitored, it is important to understand the potential impact and India's ability to recover.

The year 2025 kicks off with Standard Glass Lining, a leading manufacturer of glass-lined equipment, gearing up for its Initial Public Offering (IPO).

The year 2025 promises to be a landmark year for the Indian stock market, marking a period of glorified development and solidifying India's position as a major player on the global stage.

The Indian stock market has been a thrilling ride, a roller coaster of emotions for investors. From dizzying highs to gut-wrenching lows, it has witnessed periods of spectacular growth intertwined with moments of deep uncertainty. But through it all, the Indian market has consistently demonstrated its resilience and long-term potential.

Why Indo Farm Equipment? Indo Farm Equipment is a player in the Indian agricultural machinery market, a sector with immense growth potential. Here's why this IPO deserves a closer look:

Crucial for investors to monitor the global economic situation, the company's performance across its various business segments, and the timeline for the Jio Financial Services listing. These factors will likely play a significant role in shaping Reliance's stock trajectory in the coming months. Despite the recent dip, Reliance Industries remains a dominant player in the Indian market.

SEBI, the market watchdog, has unveiled significant new regulations aimed at enhancing investor protection and market integrity. Key highlights include a stricter framework for derivatives trading, designed to curb excessive speculation and protect retail investors.

The Indian stock market has experienced a sharp downturn, with experts attributing the decline primarily to the recent imposition of capital gains tax on foreign investors. This tax burden could significantly deter these investors, who have historically been instrumental in driving the market's growth

Market downturns often present a golden opportunity for savvy investors. When the Indian share market experiences a dip, it's not a cause for alarm but rather a signal to consider increasing your investments. This strategic approach allows you to acquire shares of promising companies at discounted prices, potentially leading to significant long-term gains.

The Indian share market is currently experiencing a period of volatility and potential downward pressure. Several factors are contributing to this trend, including concerns about global economic growth, rising interest rates, and geopolitical tensions.

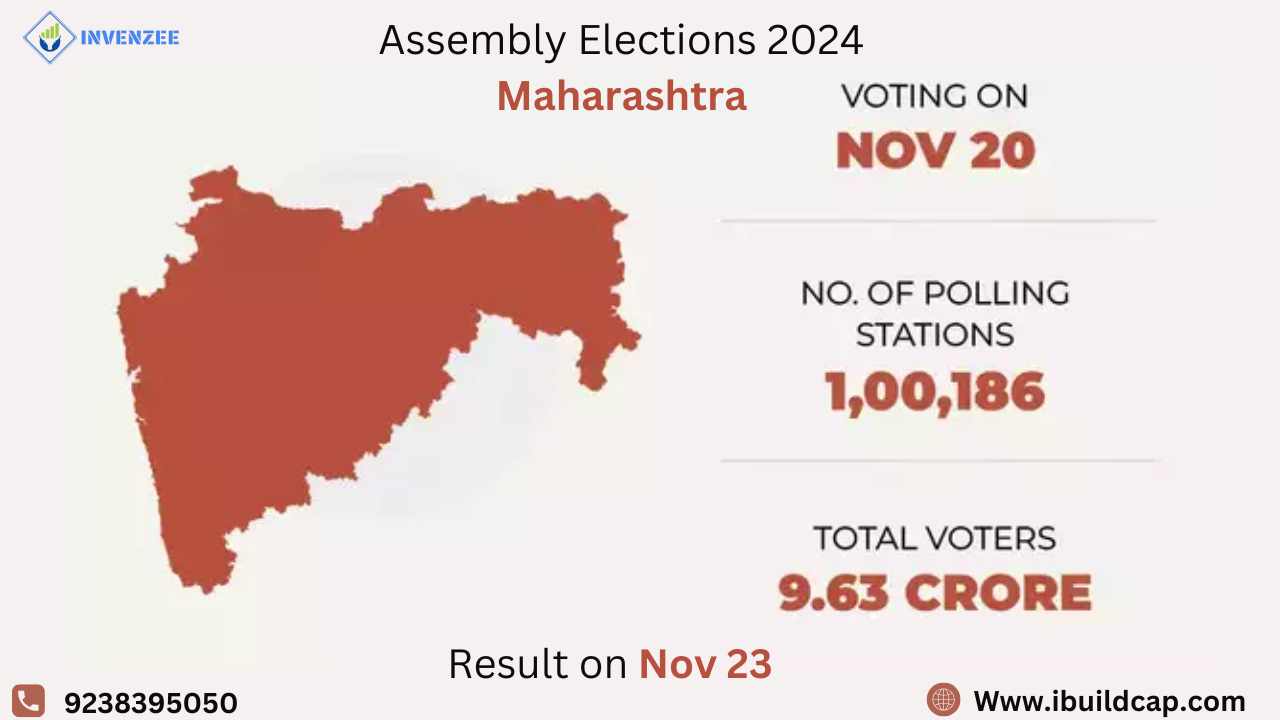

The recent Maharashtra state elections have sparked discussions about their potential impact on the Indian share market. While state elections typically don't have a direct bearing on national market movements, Maharashtra's significance as India's financial hub and the location of the Securities and Exchange Board of India (SEBI) headquarters adds a layer of interest.

The Union Cabinet has approved the PAN 2.0 Project, a significant upgrade to the existing PAN system. This initiative aims to make PAN the universal identifier for businesses and individuals, streamlining various government processes. Key features of PAN 2.0 include the incorporation of a QR code on PAN cards, a completely online application process, and the consolidation of existing identification numbers under the PAN umbrella.

Indian sports leagues, particularly cricket's Indian Premier League (IPL), have a significant impact on the Indian stock market. During these leagues, companies vie for attention and customer engagement by becoming sponsors and airing captivating advertisements. This heightened visibility and association with popular sports can positively influence investor sentiment and stock prices.

The tragic case of Atul Subhash, a Bengaluru techie who took his own life after facing alleged harassment and extortion by his estranged wife and her family, has sent shock waves across the nation. The case has sparked a debate on various issues, including the misuse of dowry laws and the importance of financial independence.

The world stage is currently marked by a number of ongoing conflicts, each with its own unique complexities and consequences. These conflicts, ranging from regional disputes to international tensions, have a profound impact on global markets, including the Indian stock market.

The Indian stock market experienced a significant rebound today, with the benchmark indices, Sensex and Nifty, closing in the green. The Sensex surged 843 points, while the Nifty reclaimed the 24,750 level, indicating a strong recovery from earlier losses. This positive market sentiment can be attributed to various factors, including positive global cues and a rebound in investor confidence.

Aarti Industries has been facing a challenging period, with its share price experiencing a significant downturn. The stock has under performed compared to the broader market indices, indicating investor concerns.

August has been a month of resilience and resurgence for the Indian share market. Despite facing initial volatility, the market has demonstrated remarkable strength, with key indices like the Sensex and Nifty steadily climbing.

The upcoming 2024 Olympics in Paris offer an exciting platform for the Indian stock market to scale new heights. With a growing contingent of talented Indian athletes

Feeling the itch to invest but overwhelmed by the options? Don't worry newbie investors! By ditching the get-rich-quick schemes and emotional knee-jerk reactions, you can take control of your financial future.

Geopolitical tensions are casting a shadow over investor sentiment today. Potential flashpoints in the Middle East, for example, are raising anxieties, as a significant escalation could lead to market swings.

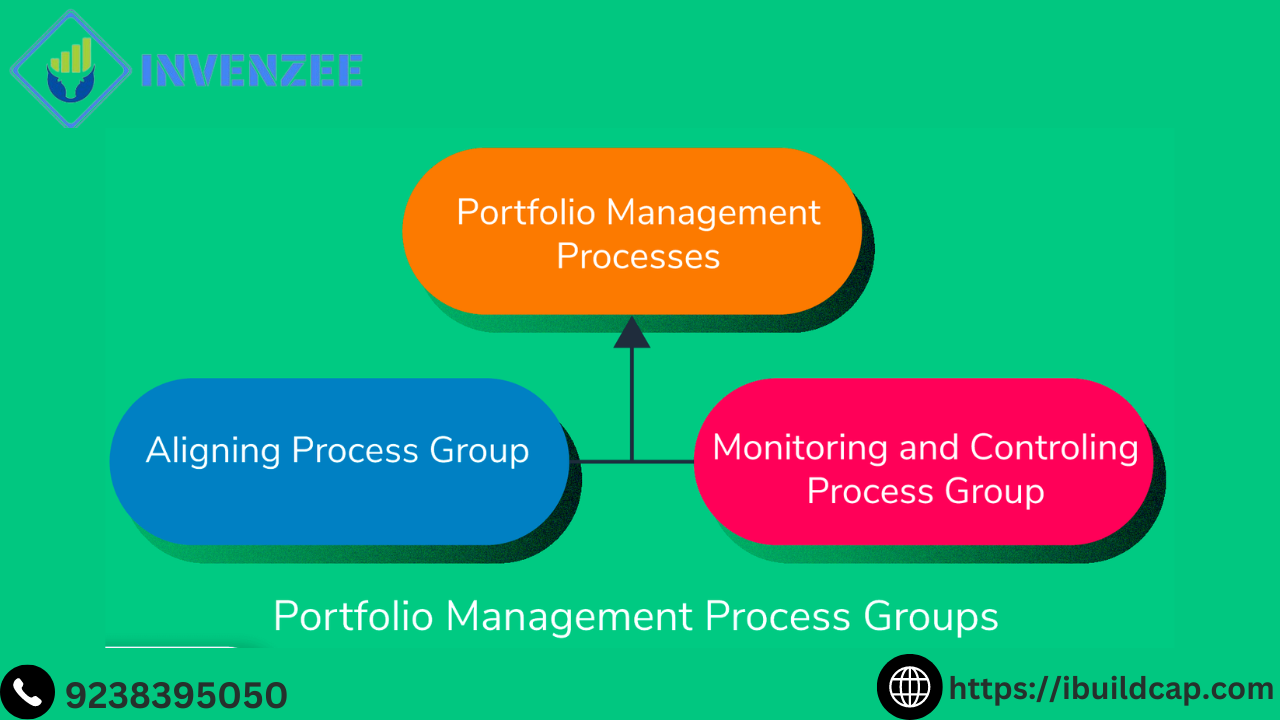

Portfolio management services (PMS) meticulously weigh several factors before buying or selling

Frankenstein's prowess isn't limited to the initial frenzy surrounding a hyped-up IPO. He also delves into the art of identifying breakout patterns in stocks that have undergone a period of stabilization following their market debut.

Seeing a stock reach an all-time high can be exciting, but it also sparks a question: is it still a good buy? While it might feel risky entering at a peak, history shows the market frequently reaches new highs, and missing out on these highs can significantly hinder long-term returns.

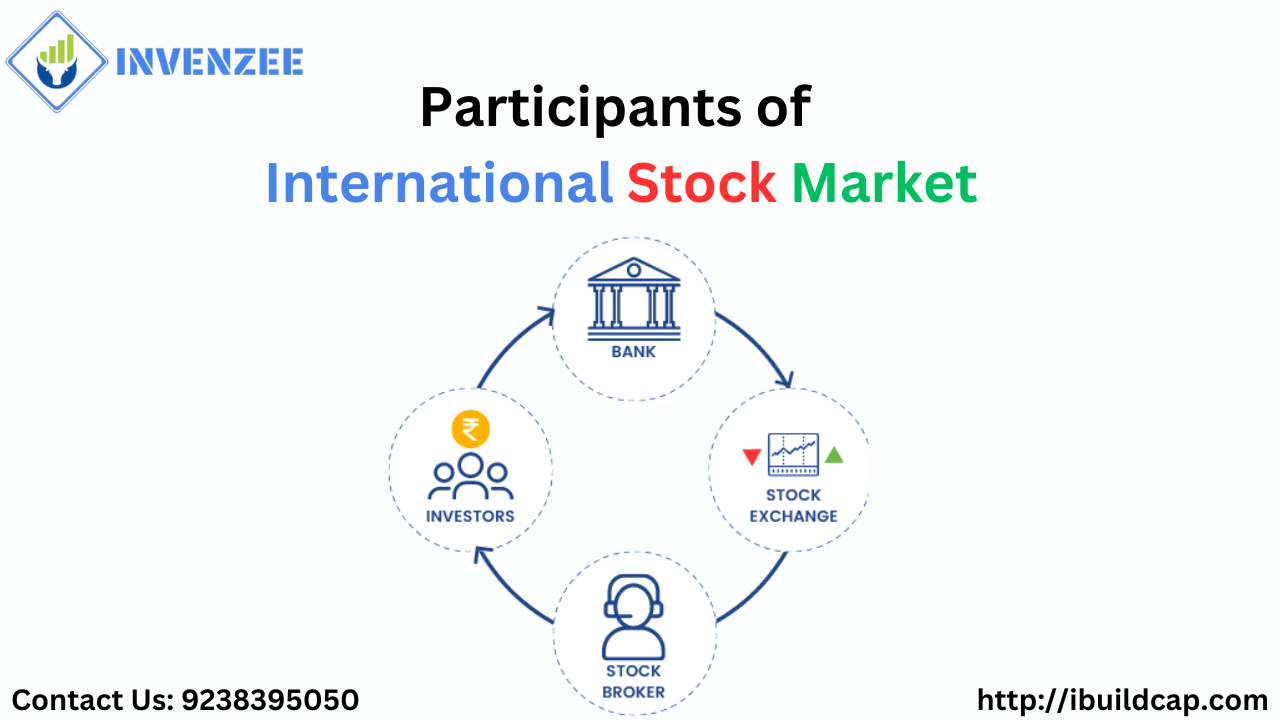

The international stock market is a vast network teeming with participants from all corners of the globe. At its core are individual investors, from seasoned professionals to first-time dabblers.

Stocks and shares are often used interchangeably, but there's a subtle distinction. Think of "stock" as the broader category. It refers to your ownership stake in one or more companies.

The dotcom bubble burst was a reckoning triggered by overinflated stock prices of internet companies in the late 1990s. A confluence of factors fuelled the frenzy: investor euphoria over the internet's potential, easy access to venture capital, and a media gush over anything with a ".com" suffix.

Finding free stock recommendations is like panning for gold – there can be flecks of value, but real success requires effort. Forget a get-rich-quick scheme; instead, focus on building your UC stock knowledge base

The way Indian team build-up 176 run target for SA was not come only from boundaries but also from the important singles and doubles too. So you can invest tiny amount for future profit too, & the way Surya kumar analyse the catch on boundary just like that do research and analyses the which share will come in PUT or CALL for catch your profit.

The world of shares can involve premiums at two key points in an investor's relationship with a company. A premium on issue arises when a company sells new shares to investors for a price higher than their face value, often referred to as par value.

Building significant wealth through stocks solely without financial knowledge is a long shot. The stock market thrives on complex interactions between companies, economies, and investor sentiment.

Absolutely, the size of companies a mutual fund invests in can significantly impact returns. Small and mid-cap funds, targeting smaller companies, tend to offer potentially higher growth but also carry greater risk

How can one while predicting the exact dance of stock prices remains an elusive dream, investors can cultivate a keen eye for the market by wielding a strategic arsenal.

Even with a small starting sum, you can begin your journey as an investor! Focus on long-term strategies like dollar-cost averaging, where you invest a fixed amount regularly.

The excitement surrounding a post-election Indian market can be contagious, and you might be tempted to invest in every initial public offering (IPO) that comes along.

The Indian stock market has experienced a period of volatility following the recent establishment of the new government

The Indian stock market's performance in June 2024 remains uncertain. The recent Lok Sabha election results sent shockwaves through the market, leading to a sharp decline on June 4th.

The Election of 2024 has some significant impact on share market and specifically on the Nifty Next 50 represents India's rising stars, companies with the potential to become tomorrow's market leaders.

The stock market is a delicate ecosystem, and the policies championed by political parties can introduce ripples of change. Party platforms often detail plans for taxes, regulations, and government spending – all of these areas can directly impact corporate profits and investor confidence

Fluctuations in currency exchange rates can significantly impact the returns on your international investments. When the value of your home currency strengthens against the currency of the company you've invested in, the overall return you receive in your home currency gets reduced.

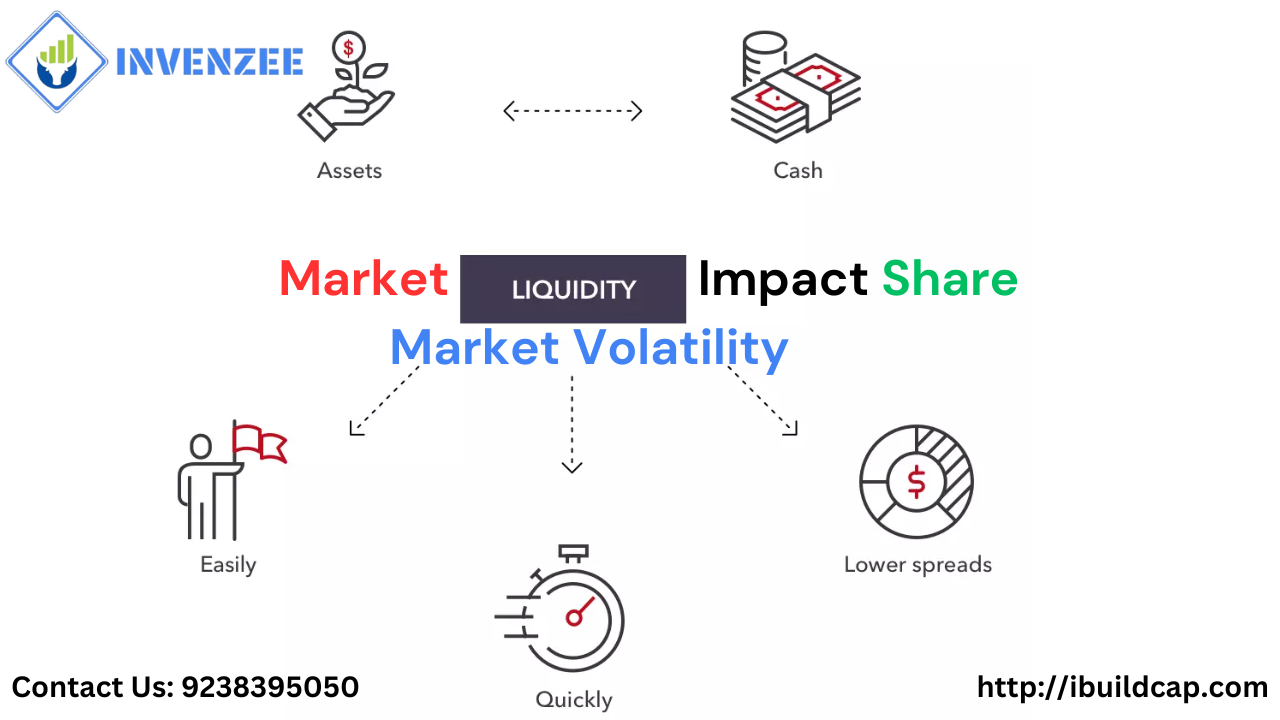

Imagine a vibrant farmers market teeming with people. Stalls overflow with fresh produce, and the air buzzes with conversation. Buyers easily find what they're looking for, and sellers can quickly offload their goods at fair prices.

The allure of the foreign exchange market, with its potential for high returns, is undeniable. However, Forex is a double-edged sword, and a cautious approach is paramount.

Stop-loss orders can be a trader's best friend, but using them ineffectively can turn them into a foe. A key mistake is setting stops too close to your entry price, where normal market fluctuations can trigger them prematurely and force you out of a position too early.

Rising inflation can erode your purchasing power over time, making your hard-earned money buy less. But fret not! By adjusting your investment strategy, you can safeguard its value.

IndiGo, India's largest airline has seen its shares take flight on the back of impressive financial results. The company reported a more than doubling of net profit in the fourth quarter of FY24, exceeding analyst expectations.

The Indian stock market has scripted a remarkable journey, leaving behind established markets to become the world's fifth largest. This rise can be attributed to several key factors.

The stock market acts like a giant thermometer for investor confidence in the global economy. When stock prices rise, it often reflects optimism about company growth and future profits.

The world of finance might be a global marketplace, but it operates with a specific schedule. Established trading hours bring several advantages to the table. First, they provide a predictable framework for buying and selling securities.

The share market, for all its potential for growth, can be susceptible to sudden and dramatic dips. These events, often called flash crashes, can leave investors bewildered.

Commodities often fly under the radar when it comes to income generation. But for those looking to diversify their portfolios or tap into a different market, commodities offer a wealth of opportunity.

Imagine a future ruled by AI, and its influence seeping into the share market. AI algorithms, already adept at processing vast amounts of data, could analyze market trends with unparalleled precision.

Indian Home Minister announcement of buying shares before 4th June, exceeding earnings expectations can lead to a surge in the market stock price as investors

There are different mortgage types, each with its pros and cons. Fixed-rate mortgages offer a steady interest rate, while adjustable-rate mortgages (ARMs) may start lower but can fluctuate.

Generally people see the stock market as a risky gamble, but in actually, it's been a strategic way to seeding for your future. By carefully researching companies and investing steadily over time, you can build a portfolio that grows alongside your needs.

Jim Simons, who sadly passed away just yesterday on May 10th, 2024, was a remarkable figure who wore many hats. He was a brilliant mathematician,

The stock market can be a surprisingly effective tool for generating side income. By strategically investing for capital gains and dividends, you can create a steady stream of income to supplement your main source.

The stock market can seem like a complex and intimidating place, but it really boils down to buying and selling pieces of ownership in companies. These pieces of ownership are called stocks, and when you buy a stock, you're essentially becoming a mini-investor in that company.

Fueled by a burgeoning economy, a youthful population, and a booming technology sector, India's stock market is poised for significant growth.

That’s little tricky Question but answer is straight… Yess!! Sports marketing can be a powerful tool for companies looking to boost their share market profile.

Expand on the different types of financial instruments you can hold in a Demat account: stocks, bonds, ETFs, mutual funds (if applicable).

Elections can jolt the stock market. Investors worry about changes in government policies that could impact the economy. This uncertainty can lead to price swings.

Stock prices are in a constant state of flux, influenced by a complex web of forces. At the core lies supply and demand – when more investors want to buy a stock than sell it, the price goes up.

Life can be unpredictable. While we can't control everything that happens, insurance offers a valuable safety net against unexpected events that can cause financial hardship.

While financial security is a cornerstone of a fulfilling life, true wealth is a multifaceted treasure.To cultivate this multifaceted wealth, intersectionality is key.

Dive Deeper Than NAV: Go beyond the Net Asset Value (NAV) with Sharpe Ratio and Jensen's Alpha to assess a fund's risk-adjusted performance and identify those that consistently beat the benchmark.

In the share market today is the surge in popularity of sustainable investing. This approach focuses on companies that prioritize environmental, social, and governance (ESG) factors alongside traditional financial metrics.

The share market beckons with the promise of significant returns, but can you predict exactly how much you'll earn in 2024? Unfortunately, there's no one-size-fits-all answer, but as for Indian share market due to election impact possibility for positive outcome is high.

© Copyright 2024-25 by iBuildCap - all right reserved